Demystifying Project Finance: The Significance of Financial Closure in Assessing Project Loans

Project finance serves as a cornerstone for funding large-scale infrastructure, energy, and development projects worldwide. Unlike traditional corporate finance, project finance involves structuring financing arrangements based on the cash flow and assets of a specific project, rather than the creditworthiness of a corporate entity. Central to the success of project finance is the concept of financial closure, which plays a pivotal role in assessing project loans. In this blog post, we delve into the intricacies of project finance and highlight the relevance of financial closure in the evaluation of project loans.

Understanding Project Finance: Project finance refers to the financing of long-term infrastructure, energy, or industrial projects where lenders primarily rely on the project's cash flow and assets as collateral. Unlike corporate financing, project finance typically involves a special purpose vehicle (SPV) established solely for the purpose of executing the project. The SPV isolates the project's assets and liabilities from the sponsoring company's balance sheet, mitigating risks associated with corporate bankruptcy and enhancing project bankability.

Relevance of Financial Closure: Financial closure represents a critical milestone in the lifecycle of a project, marking the point at which all necessary financing arrangements and contractual agreements are in place to commence project execution. Achieving financial closure signifies the project's financial viability and the confidence of lenders and investors in its success. Moreover, financial closure serves as a prerequisite for disbursing project loans and unlocking capital for project implementation.

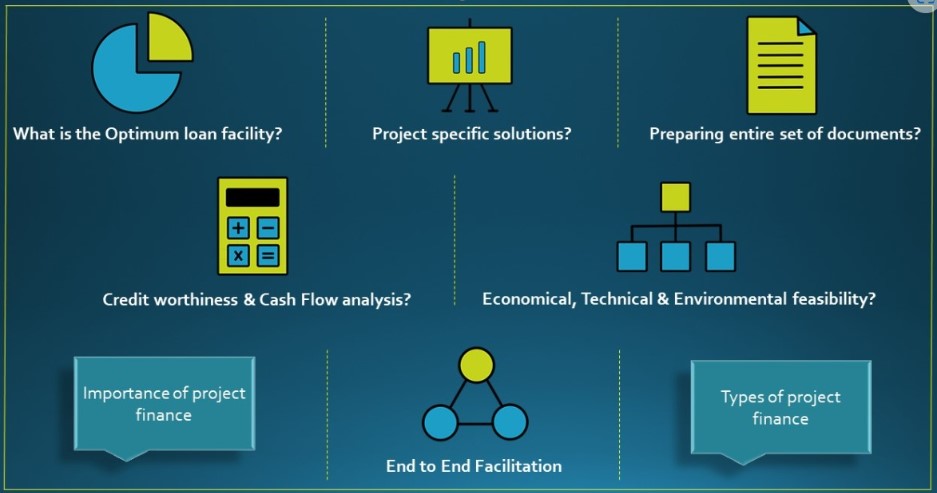

Assessment of Project Loans: Assessing project loans involves a comprehensive evaluation of various factors to determine the creditworthiness and risk profile of the project.

Key considerations in the assessment of project loans include:

Financial Viability: Lenders evaluate the project's financial projections, including revenue forecasts, operating expenses, and cash flow projections, to assess its ability to generate sufficient returns to service debt obligations. Financial models are used to simulate different scenarios and stress test the project's financial resilience against adverse market conditions.

Project Structure: The contractual framework governing the project, including concession agreements, off-take agreements, and construction contracts, is scrutinized to assess the project's legal and regulatory risks. Lenders seek to mitigate risks through robust contractual arrangements that allocate responsibilities and mitigate potential disputes among project stakeholders.

Risk Allocation: Project loans involve the allocation of risks among various parties, including lenders, sponsors, and contractors. Lenders conduct thorough due diligence to identify and mitigate project risks, such as construction delays, cost overruns, regulatory changes, and market fluctuations. Risk mitigation strategies may include insurance coverage, guarantees, and contingency reserves.

Security Package: Lenders typically require a comprehensive security package to mitigate credit risk and protect their interests in the event of default. Collateral may include tangible assets such as land, equipment, and infrastructure, as well as contractual rights such as revenue streams and insurance proceeds. The adequacy and enforceability of security arrangements are crucial considerations in assessing project loans.

Conclusion: In conclusion, project finance plays a vital role in funding large-scale infrastructure and development projects, leveraging the project's cash flow and assets as collateral. Financial closure represents a crucial milestone in the project lifecycle, signaling the readiness of the project for implementation and the confidence of lenders and investors in its success. Assessing project loans requires a thorough evaluation of financial viability, project structure, risk allocation, and security arrangements to mitigate risks and ensure the project's long-term sustainability. By understanding the intricacies of project finance and the relevance of financial closure, stakeholders can navigate the complexities of project financing and facilitate the successful execution of infrastructure projects for the benefit of society.